Navigating the world of business incorporation tax can feel like trying to solve a Rubik’s Cube blindfolded. It’s complex and a bit daunting, but it doesn’t have to be! Understanding the ins and outs of incorporation tax is crucial for any entrepreneur looking to keep their hard-earned cash from disappearing faster than a magician’s rabbit.

Table of Contents

ToggleUnderstanding Business Incorporation Tax

Business incorporation tax encompasses various taxes imposed when establishing a corporate entity. This tax varies significantly based on the business type and jurisdiction.

What Is Business Incorporation Tax?

Business incorporation tax refers to the taxes required for registering a business as a corporation. Corporations often incur taxes at both federal and state levels. Common types include income tax on corporate profits and franchise taxes, which some states require for incorporating. The calculation of these taxes depends on factors such as business profits and state-specific rates. Each business must comply with regulations to avoid penalties.

Importance of Business Incorporation Tax

Understanding business incorporation tax is crucial for financial management. Entrepreneurs can secure personal assets from liabilities through proper incorporation. Additionally, awareness of tax obligations ensures compliance with tax laws, reducing risks of audits. Its implications directly affect cash flow and operational costs, influencing overall business success. Business owners benefit from consulting with tax professionals for accurate reporting and strategic planning.

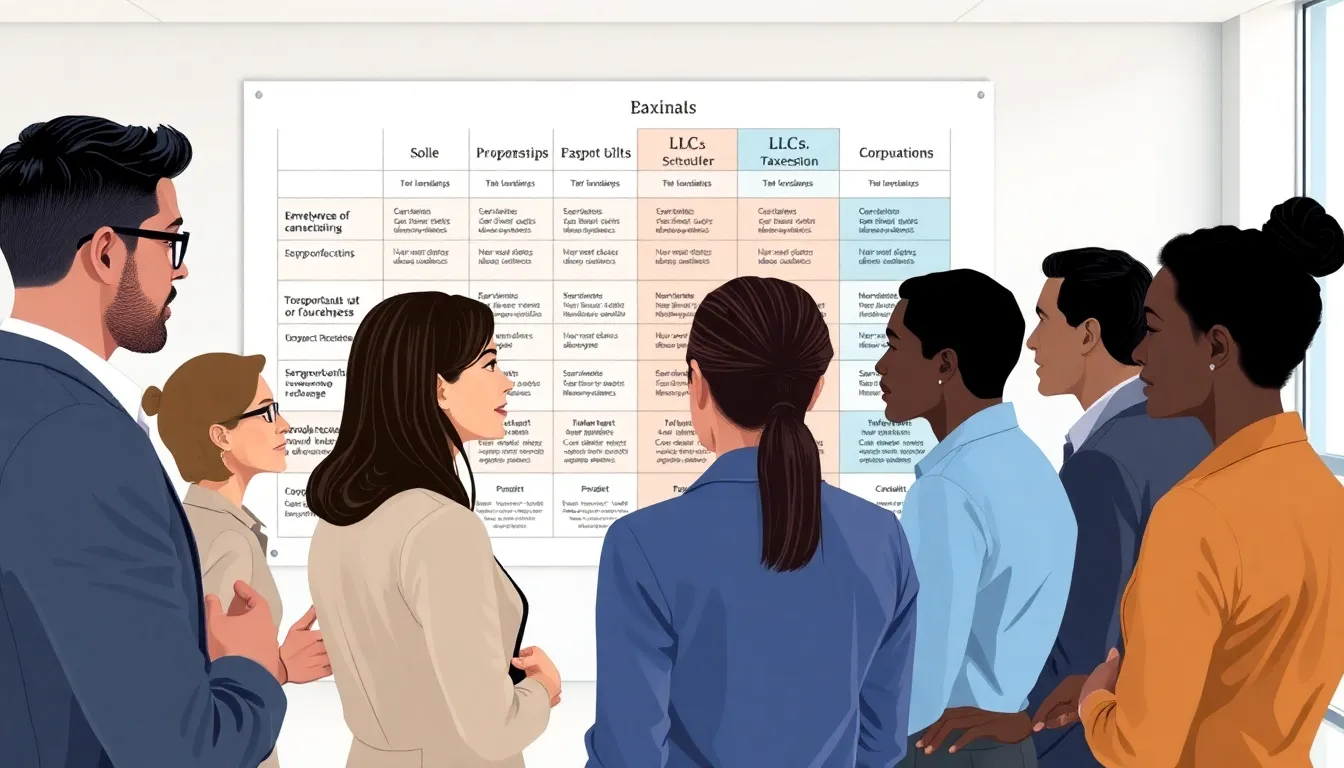

Types of Business Structures and Their Tax Implications

Understanding different business structures helps clarify their respective tax implications. Each structure carries unique tax liabilities and benefits.

Sole Proprietorship

A sole proprietorship is the simplest business structure. It doesn’t necessitate formal incorporation, making it easy to start. Tax benefits include reporting business income on the owner’s personal tax return, avoiding separate corporate taxes. Owners pay self-employment taxes on net earnings, which can impact personal finances. Losses can offset income, providing some tax relief. Therefore, accountability falls on the owner, exposing personal assets to business liabilities.

LLC (Limited Liability Company)

An LLC blends features of sole proprietorships and corporations. Limited liability protects personal assets from business debts, creating a financial buffer. Owners have flexibility in choosing how to be taxed, either as sole proprietors or corporations. This flexibility allows for pass-through taxation, where profits and losses pass through to personal tax returns, preventing double taxation. Moreover, self-employment taxes apply to members, influencing overall tax responsibility.

Corporation

A corporation offers strong liability protection. It functions as a separate legal entity, maintaining distinct tax obligations. Corporations face corporate income tax, which is applied to profits before distributed to shareholders. Dividends distributed to shareholders subject them to personal tax, leading to double taxation. Various types of corporations, such as C-Corps and S-Corps, affect taxation strategies and compliance requirements. Understanding these differences is crucial for effective tax planning and financial viability.

The Process of Business Incorporation Tax

Understanding the process of business incorporation tax is crucial for entrepreneurs. It involves several key steps that ensure compliance with legal and tax obligations.

Steps to Incorporate a Business

First, select a suitable business structure. Options include sole proprietorships, LLCs, or corporations, each with different tax implications. Next, choose a business name that complies with state regulations. After naming, file the necessary incorporation documents with the state, typically including Articles of Incorporation. Additionally, consider obtaining any required licenses or permits. Lastly, acquire an Employer Identification Number (EIN) from the IRS. This number serves as a tax ID for the business.

Tax Registration Requirements

Tax registration starts with understanding obligatory federal and state tax filings. Corporations usually face corporate income tax, while LLCs can opt for pass-through taxation. Registering for state taxes is often required if the business has a physical presence or employees in a state. Businesses may also need to handle franchise taxes, varying by state. Consult local regulations to ensure compliance. Proper registration prevents penalties and supports effective financial management.

Benefits of Incorporating for Tax Purposes

Incorporating a business provides several tax advantages. Entrepreneurs can leverage specific deductions to reduce taxable income significantly.

Tax Deductions Available

Tax deductions play a crucial role in lowering overall tax liability. Corporations may deduct business expenses such as salaries, rent, utilities, and equipment costs directly from taxable income. Additionally, benefits like health insurance premiums for employees are fully deductible. Certain start-up costs, including research and development tickets, also qualify for deductions. These deductions result in reduced federal and state tax obligations, promoting better financial health for the business.

Liability Protection

Liability protection stands as another vital benefit of incorporating. A corporation or LLC creates a separate legal entity, shielding personal assets from business debts. This separation limits the owner’s personal liability for company obligations, such as loans or legal actions. In the event of a lawsuit, personal finances remain protected, which significantly reduces financial risk. This protection encourages entrepreneurs to invest more confidently in their business ventures.

Conclusion

Navigating the world of business incorporation tax can feel overwhelming but understanding its intricacies is vital for any entrepreneur. By choosing the right business structure and staying compliant with tax regulations, they can protect their personal assets and enhance their financial management. Incorporation not only offers potential tax advantages but also minimizes financial risk, allowing business owners to focus on growth. Seeking guidance from tax professionals can provide clarity and strategic insights, ensuring that entrepreneurs make informed decisions that benefit their ventures in the long run.